Here are the 2-step process for your tax registration in Malaysia. They will be subject to.

How To Step By Step Income Tax E Filing Guide Imoney

Companies limited liability partnerships trust bodies and cooperative societies which are dormant andor have not commenced business are.

. The Malaysian tax year runs from January 1st - December 31st. Income derived in Malaysia by a non-resident public entertainer is subject to a final withholding tax at a rate of 15. Foreigners who stay and work in Malaysia for more than 182 days are subject to tax and they must file and pay their tax to the Inland Revenue Board of Malaysia.

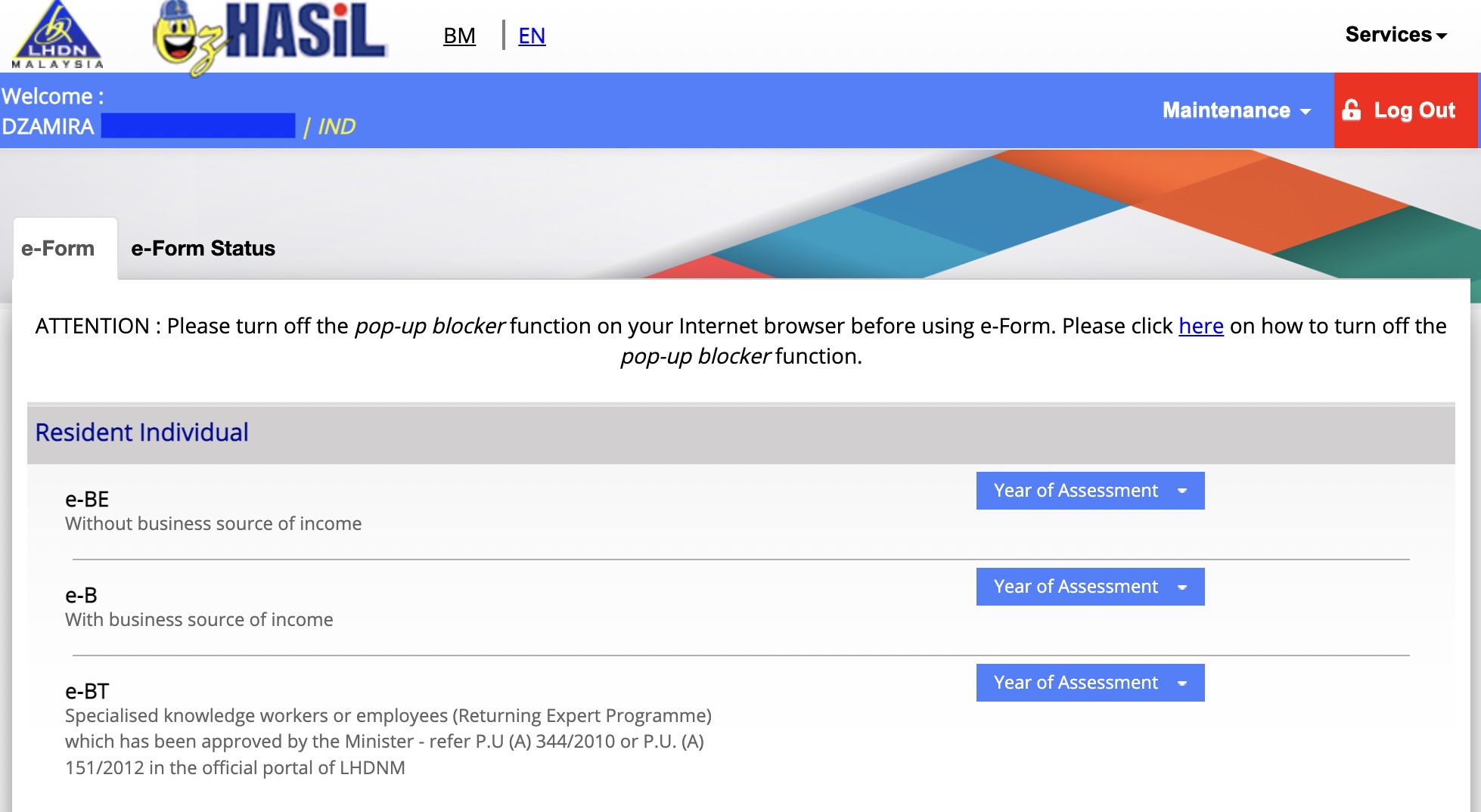

How Does Monthly Tax Deduction Work In Malaysia. At the various options available on the ezHASIL page choose myTax. Alternatively you can either check online via e-Daftar or give LHDN a call at 03-89133800.

Go to e-filing website. The employment income receivable in the following year whether received or not on an individual who has left of will be leaving Malaysia in which he is a non-resident in the following year will be taxed in the year he leaves Malaysia permanently as provided under subsection 25 6 of the ITA. The deadline for filing your tax return depends on where your income comes from.

The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. Login to e-filing website. Latest salary statement payslip.

Contract payments to non-resident contractors are subject to a total withholding tax of 13 10 for tax payable by the non-resident contractor and 3 for tax payable by the contractors employees. However if you derive income from employment then you have to file your taxes before April 30th. Foreigners who qualify as tax-residents follow the same tax guidelines progressive tax rate and relief as Malaysians and are required to file income tax under Form B.

Click on e-Filing PIN Number Application on the left and then click on Form CP55D. This will lead you to the main page of the the e-filing system. The participating banks are as follows.

Fill in the required details and attach your Form CP55D. Tax Offences And Penalties In Malaysia. They need to apply for registration of a tax file.

Those who are to be taxed for the first time must register an income tax reference number before proceeding as mentioned above. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. Meanwhile for the B form resident individuals who carry.

On the other way round according to the Income Tax Act 1967 only income derived from Malaysia is subject to income tax in Malaysia while income earned outside Malaysia is not. Non-residents are taxed a flat rate based on their types of. To register or log in to your e-Filing for the first time youll need a PIN provided by the LHDN.

After registering LHDN will email you with your income tax number within 3 working days. All tax residents subject to taxation need to file a tax return before April 30th the following year. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing.

You can either visit the LHDN Customer Feedback website and. As for those filling in the B form resident individuals who carry on business the. 1 Pay income tax via FPX Services.

How To Pay Your Income Tax In Malaysia. Where a company commenced operations. If youre self-employed for instance then the deadline is June 30th.

Here are the many ways you can pay for your personal income tax in Malaysia. Failure to do so can result in a 10 increment of the payable tax or a disciplinary fee. The tax year in Malaysia runs from January 1st to December 31st.

To complete a tax return expats need to fill out a Yearly Remuneration Statement EA. When registering the taxpayer is required to bring along the following items. Guide To Using LHDN e-Filing To File Your Income Tax.

The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. First of all you need an Internet banking account with the FPX participating bank. Go back to the previous page and click on Next.

When you arrive at IRBs official website look for ezHASIL and click on it. For the BE form resident individuals who do not carry on business the deadline falls on either 30 April 2022 manual filing or 15 May 2022 e-Filing. Click on Permohonan or Application depending on your chosen language.

There are however certain extra steps that freelancers will need to take as they will be affected by the following. Registration of companys tax file is the responsibility of the individual who managing and operating the company. Overall the tax filing process will not be tremendously different between an employed individual and freelancers.

Non-resident stays in Malaysia for less than 182 days and is employed for at least 60 days in a calendar year. The FPX Financial Process Exchange gateway allows you to pay your income tax online in Malaysia. This is with the exception of those who carry out partnership businesses in Malaysia.

Pin By Raquel Givens On Graphic Design Infographics Infographic Online Business Infographic Design

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Pin On Google Seo Digital Marketing Performance Report

Yc Backed Cleartax Embarks Upon India S Fast Growing Online Tax Filing Market Http Tropicalpost Com Yc Backed Cleartax Emb Filing Taxes Online Taxes Start Up

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Advantages And Disadvantages Of Gst In Malaysia Financial Aid For College Tax Software Mortgage Interest

How To File Income Tax In Malaysia 2022 Pt 2 Complete Guide To File Tax Returns Lhdn Youtube

Guide To Using Lhdn E Filing To File Your Income Tax

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Guide To Using Lhdn E Filing To File Your Income Tax

Guide To Using Lhdn E Filing To File Your Income Tax

Malaysia My Second Home Mm2h By Ck Chong Via Slideshare Malaysia Home Come And Go

P Cecilia I Will Provide Accounting And Tax Services Malaysia For 190 On Fiverr Com Accounting Services Tax Services Bookkeeping Services

Filing Your Taxes For The First Time In Malaysia Read This First Ya 2021 Althr Blog

How To File Your Taxes For The First Time

Do You Need Help Filing Your Income Tax Returns Get Help From An Expert Taxithere Helps To File Your Income Tax Return Filing Taxes Tax Services Online Taxes

7 Tips To File Malaysian Income Tax For Beginners

Best Payroll And Tax Services In Switzerland